Kansas’ Marshall testifies in favor of Credit Card Competition Act

"We Must Choose Main Street Businesses over Wall Street Giants"

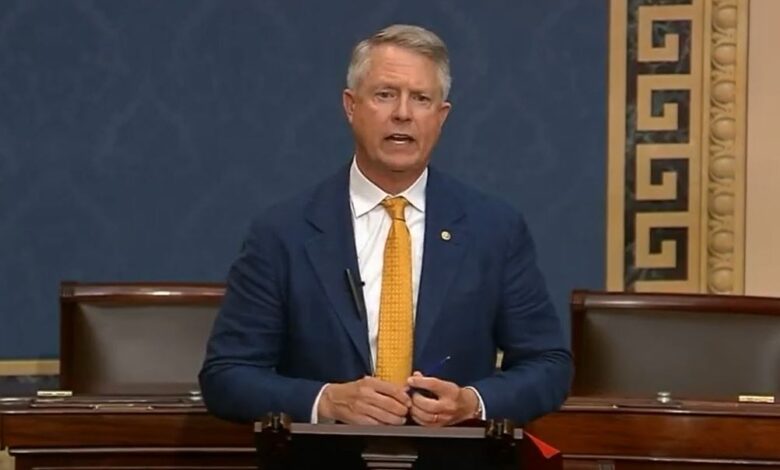

Washington, D.C. – U.S. Senator Roger Marshall, M.D. delivered opening remarks in the Senate Judiciary Committee to advocate for a vote on the Credit Card Competition Act, urging Congress to choose Main Street over Wall Street and stand with American consumers instead of multibillion-dollar corporations and megabanks.

Credit card swipe fees are an inflation multiplier- crushing our Main Street small businesses and consumers. The Visa-Mastercard duopoly and their Wall Street allies have total control over these price-gouging fees. Senator Marshall, alongside Majority Whip Senator Dick Durbin (D), are trying to change that by injecting more competition into the system with the bipartisan Credit Card Competition Act.

Highlights from Senator Marshall’s remarks include:

“Swipe fees are inflation multipliers. Let me say that again: swipe fees are inflation multipliers.”

“Here’s the facts: the average American family spends over $1,100 annually on swipe fees. $1,100. In the United States, swipe fees are over nine times higher than in the EU, four times higher than China, and twice that of Canada. Last year alone, the retailers paid over $170 Billion in swipe fees. For small businesses, these fees are second only to labor costs, often exceeding utilities or even health care expenses for their employees.”

“Meanwhile, the average credit card interest rate has soared to 24%. 24% interest rate on your credit cards, and late fees have added another $14 billion of cost to consumers. When it’s all said and done, for retailers and consumers together, the cost is almost $300 billion annually, which amounts to over $2,200 per family.”

“Visa operates as a virtual monopoly – at least, that’s what the DOJ is accusing them of, working in tandem with Mastercard, partnering with a number of Wall Street mega-banks, and thus controlling over 80% of the market. Is there anything fair about this?”

“I want everyone on the committee to know this: we did a professional survey of several issues back home – now this was not a push poll, it was a professional survey. Over 10,000 people returned the survey, and what were the findings? Not 70, not 80, not 90 – 96% of the people on this survey support our credit card bill.”

“I have to add, when the opponents of this bill have spent $80 million attacking myself, the chairman and this bill, that’s over twice what was spent against me in a Senate race – you know that you’re over the target.”

“Let’s be clear: whether it’s inflation or sales taxes or in this case, swipe fees, when those go up, consumers ultimately pay the price. The retailers pass those expenses on to consumers – it’s that simple…I’m a hands-off, free-market capitalist, but capitalism without competition leads to unchecked greed, the exploitation of hardworking Americans, and the erosion of opportunity.”

“I remind everyone that American credit card debt is at an all-time high of over a trillion dollars. Lest you feel sorry for these monopolies, Mastercard enjoys a profit margin of over 44% and Visa over 55%.”

“I ask everyone on this committee and in Congress, why would we stand by and allow Wall Street monopolies to siphon more and more money from our communities back home to enrich themselves…When faced with a choice, I’ll always side with Main Street over Wall Street and working Americans over monopolistic corporations. Let’s all take this opportunity to stand up for the people who get paid by the hour and carry a lunch pail to work.